Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

Improving Integrated Care for the Dually Eligible: Policy Recommendations for New York

- Positions and Publications

About the Medicare Rights Center

Based in New York, the Medicare Rights Center is a national, nonprofit consumer service organization that works to ensure access to affordable health care for older adults and people with disabilities through counseling and advocacy, educational programs, and public policy initiatives. Since 1989, Medicare Rights has helped people with Medicare understand their rights and benefits, navigate the Medicare system, and secure the quality health care they deserve.

Support for this work was provided by the New York Health Foundation (NYHealth) and the Samuels Foundation.

Summary

In 2022, the New York State Department of Health (NYSDOH) released its Dual Eligible Integrated Care Roadmap, which outlined the state’s many priorities for improving integrated care for those dually eligible for Medicare and Medicaid.[i] By promoting integrated care for duals, they hoped to improve health outcomes, enhance member satisfaction, and reduce costs. One of the most ambitious goals was a 250% increase in the number of dually eligible individuals receiving integrated care through an aligned contract—meaning that the individual’s Medicare and Medicaid benefits are provided by the same company—by the end of 2023. These aligned contracts include the state’s Integrated Benefits for Dually Eligible Enrollees (IB-Dual) program and Medicaid Advantage Plus (MAP) plans.

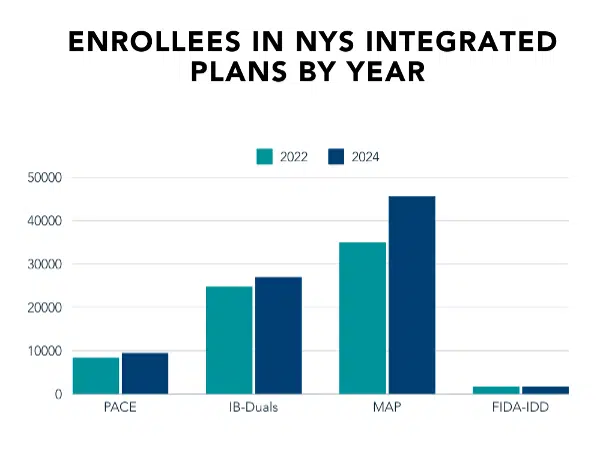

New York has yet to achieve this 250% increase, in part because of the state’s recent Medicaid expansion—which extended eligibility to 138% of the federal poverty level—has greatly increased the population of fully dual eligible beneficiaries.[ii] But enrollments in integrated care options have increased by 30% since 2020.[iii][iv] Controversial mechanisms like default enrollment—which allows insurers to move newly Medicare-eligible Medicaid managed care enrollees into a qualifying D-SNP—also enable insurers to transition beneficiaries to aligned contracts when they become eligible for Medicare. And plans continue to join the integrated care market. At the current pace, NYSDOH may achieve its target 250% increase in the next few years.

Unfortunately, even while New York seeks greater enrollment into integrated care products, the state and insurers have failed to address several integrated care issues that could improve the health and wellbeing of the very population that integration intends to serve. Every year, the Medicare Rights Center counsels thousands of dually eligible older adults and people with disabilities on its helpline, educating them on coverage options, troubleshooting enrollment problems, assisting in provider searches, and much more. While we support the aims of integration and applaud the state for continuing to consider the coverage needs of dually eligible individuals, pitfalls remain that need to be tackled.

The following report explores integrated care pitfalls encountered on Medicare Rights’ helpline and offers recommendations that policymakers can adopt to improve integrated care in New York. It is unclear whether NYSDOH plans to update its roadmap for 2024 and beyond, as there have been many changes to the integrated care landscape since the document’s original publication. Medicare Rights hopes this paper’s recommendations can be useful to NYSDOH officials and other policymakers as they determine future integrated care priorities.

Background

Integrated care refers to the coordination of Medicare and Medicaid benefits for dually eligible individuals. This coordination is primarily accomplished through private plans that pay for and deliver a person’s Medicare and Medicaid services. Integrated care is intended to make it easier for duals to access quality care and avoid unnecessary duplication of services.

In New York, there are several different options for duals interested in integrated care, some of which are included in the Department of Health’s roadmap:

- Dual-eligible Special Needs Plans (D-SNPs) with aligned contracts: A D-SNP is a kind of Medicare Advantage plan. D-SNPs with aligned contracts are called the Integrated Benefits for Dually Eligible Enrollees (IB-Duals) program. Individuals who are not in need of long-term care (LTC) services can enroll in a D-SNP combined with a Medicaid Managed Care (MMC) plan or a Health & Recovery Plan (HARP), which coordinates and expands access to behavioral health and HCBS services. Alignment means that the D-SNP and the MMC or HARP plan are offered by the same health insurance company.

- Medicaid Advantage Plus (MAP): MAP is a type of D-SNP available for individuals who need long-term care. These plans meet the requirements to be designated as Fully Integrated Dual-Eligible SNPs (FIDE-SNPs). Under MAP, one private plan administers Medicare, Medicaid, long-term care, behavioral health, and drug coverage benefits.

- Program of All-Inclusive Care for the Elderly (PACE): PACE provides integrated Medicare, Medicaid, and long-term care services and is available in select New York counties.

- Fully Integrated Duals Advantage for people with Intellectual or Developmental Disabilities (FIDA-IDD): FIDA-IDD is a Medicare and Medicaid program for adults with intellectual and developmental disabilities. All Medicare and Medicaid benefits are offered by one plan. The FIDA-IDD demonstration is set to end on December 31, 2024.

PACE remains a relatively small program in New York, with approximately 9,500 enrollees in March 2024. Comparatively, MAP and IB-Duals have enrollments of 45,622 and 27,000, respectively. MAP has also seen a 30% increase in enrollees since December 2022.[v]

Augmenting growth into MAP and IB-Duals plans is the fact that many of these plans have been approved for default enrollment in New York. The default enrollment process allows eligible insurance companies to move newly Medicare-eligible MMC enrollees into a qualifying D-SNP. As of January 2024, nine plans have received state approval for default enrollment, up from five in 2021.

To improve the ability of dually eligible New Yorkers to navigate health coverage and access needed health care, this paper highlights some of the most common problems with integrated products, as heard on the Medicare Rights Center’s helpline.

Common Obstacles for People Enrolled in Integrated Care

The following cases draw on the stories and experiences of thousands of dually eligible individuals who have been served by Medicare Rights’ helpline in recent years.

Obstacle 1: Education

Mr. L was interested in receiving long-term care, so he contacted the New York Independent Assessor Program (NYIAP) to learn whether he met the eligibility requirements. After receiving an outcome notice from NYIAP that confirmed his eligibility, Mr. L was uncertain how to proceed. He contacted Medicare Rights, where a counselor provided him with counseling about his coverage options. Because Mr. L needed long-term care, we advised him to choose a managed long-term care (MLTC) plan or enroll in Medicaid Advantage Plus. Mr. L seemed receptive to the idea of a single plan covering all his benefits. When he later mentioned his need for behavioral health coverage, we determined that MAP would best suit his needs, thanks to the fact that it began to offer expanded behavioral health benefits in 2023. Medicare Rights then helped Mr. L contact New York Medicaid Choice (NYMC) to begin his enrollment.

Mr. L’s experience shows that even people who complete the eligibility process with NYIAP and receive notice can be unaware of their coverage options and unclear about the steps they need to take to get coverage. Currently, available educational resources on integrated care plans include a New York Medicaid Choice brochure and the NYSDOH website page entitled Integrated Care Plans for Dual Eligible New Yorkers. Both resources are difficult to find on their corresponding websites. The NYMC brochure addresses clients with long-term care needs but has no information on the IB-Duals program or options for those with behavioral health needs. NYSDOH’s webpage has been a resource for advocates, but it is not sufficient as a tool for consumers in need of choice counseling.

While the Independent Consumer Advocacy Network (ICAN) ombudsman program can help New Yorkers seeking answers about how integrated care can work for them, New York needs to improve and expand its integrated care messaging, materials, and assistance to reach more eligible individuals. This work includes improving website content and accessibility and expanding on content in the New York Independent Assessor Notice—many individuals’ first contact with the idea of integrated care—to better direct people toward next steps and help them navigate plan options.

Obstacle 2: Enrollment

Using default enrollment, Health Plan A enrolled Ms. R into a Medicaid Advantage Plus plan when she turned 65. A few months later, Ms. R received a marketing message from Health Plan B, a D-SNP. Health Plan B assured Ms. R they could provide her with a wider variety of benefits and no copayments for services. Ms. R decided to enroll in Health Plan B’s D-SNP over the phone.

Ms. R called Medicare Rights after realizing she was losing her long-term care benefits, provided through her MAP plan. She was unaware that long-term care coverage was tied to the MAP plan and that Health Plan B’s D-SNP would not provide coverage for the same benefits.

The state must ensure that beneficiaries do not lose access to long-term care services after knowingly or unknowingly disenrolling from the Medicare portion of their MAP plan. Many beneficiaries are misled, misinformed, or do not understand the detrimental impact of changing their coverage. As a result of heavy marketing from insurance companies, a lack of consumer-focused information explaining MAP and other integrated care options, and failures in plan oversight, the health of beneficiaries is needlessly put at risk as they attempt to navigate a complicated system.

Along with the state, insurance companies should be responsible for educating enrollees and prospective enrollees on how enrollment and benefits will work under their plans. Currently, insurers eligible to use default enrollment must send a notice to enrollees identified for default enrollment at least 60 days before the start date of their Medicare coverage. This 60-day notice must provide information comparing the beneficiary’s current coverage with new coverage, including differences in benefits and cost-sharing. Notices also provide instructions for those interested in declining enrollment and joining Original Medicare or a different Medicare Advantage Plan. However, notices do not currently give beneficiaries adequate information on these other coverage options and how they differ. An improved 60-day notice and additional outreach following the 60-day notice is necessary to ensure that beneficiaries make informed decisions. This is especially true for new-to-Medicare beneficiaries, who may easily miss the 60-day notice because they are inundated with insurance marketing.

Obstacle 3: Supplemental benefits

Mr. K is dually eligible with a Medicaid Managed Care plan and, for the Medicare portion of his coverage, an aligned D-SNP (taken together, this means he has an IB-Dual plan). He scheduled a needed oral surgery with a dentist in his D-SNP’s provider network. While his D-SNP paid for some of the costs associated with his care, Mr. K was left with a bill for approximately $9,000. After receiving this bill, Mr. K tried to submit it to his Medicaid plan for payment, knowing that Medicaid also covers dental services. However, Mr. K received a denial from Medicaid because the dentist in his D-SNP’s network does not accept Medicaid.

When Mr. K called Medicare Rights, he knew he had some level of dental coverage through his plan but was unaware that in-network providers for his D-SNP might not accept his Medicaid insurance. As it turned out, the dental coverage available through his D-SNP was only for routine dental services. Mr. K should have instead sought out a dentist who accepts his Medicaid insurance, as Medicaid would cover more comprehensive care. The incongruency of Medicare and Medicaid provider networks and the lack of clear information about his dental coverage options caused Mr. K to make a costly mistake.

NYSDOH’s 2022 roadmap set an 80% network congruency goal by January 1, 2024. This means that in 2024, 80% of the providers in certain types of D-SNP networks, like MAP, must accept both Medicare and Medicaid. This network congruency goal has helped improve the experience of duals in aligned plans by ensuring that most of their in-network providers accept their Medicaid coverage. This is not a federal requirement, and New York should be recognized for its decision to require 80% network congruency for certain D-SNPs.

NYSDOH is also aware of the issues specific to duals seeking dental care. The agency has recently proposed that all D-SNPs use the supplemental benefits rebate available under Medicare Advantage to provide comprehensive dental coverage matching Medicaid. Unfortunately, these solutions are unlikely to solve problems for clients like Mr. K. When plans deny coverage or an enrollee does not meet eligibility criteria for D-SNP coverage of a dental service, the enrollee may find that their in-network providers do not accept Medicaid without a 100% network congruency.

Recommendations

The following recommendations directly address problems. We hope the state will consider them when determining New York’s next set of priorities for integration in 2024 and beyond.

- Develop culturally competent educational resources that explain integrated care options, including MAP, PACE, and IB-Duals. Telephone numbers to entities like New York’s Independent Consumer Advocacy Network (844-614-8800) and the Community Health Access to Addiction & Mental Health Care Project (888-614-5400) should also be prioritized on materials so that beneficiaries needing counseling can get unbiased help.

- Address the unintended consequences of MAP disenrollment. For individuals not to lose critical long-term care coverage, those who disenroll from their MAP plan to join a different D-SNP or Medicare product—and are thereby disenrolled not just from the Medicare portion of the plan but also the Medicaid long-term care portion—should be automatically enrolled in the same MAP plan’s sister managed long-term care plan. Additionally, plans should be required to have procedures in place that trigger choice counseling sessions for enrollees who are considering disenrollment to prevent them from unintentionally interrupting care.

- Set a goal of 100% network congruency for D-SNPs. All providers accepting both Medicare and Medicaid will improve consumer experiences and push D-SNPs to be more beneficial for enrollees.

- Work with plans to ensure that there are clear explanations of D-SNP benefits available, including which are Medicaid benefits and which are Medicare supplemental benefits. Without this information, people may misunderstand what benefits they already have available under Medicaid.

- Require aligned D-SNPs to more meaningfully coordinate Medicare and Medicaid services and a no wrong door policy when members contact either the D-SNP or the Medicaid plan.

- Create additional opportunities to provide updates to stakeholders and receive feedback on state initiatives and the State Medicaid Agency Contract (SMAC). A DOH-led multi-stakeholder advisory group with quarterly meetings would improve communication between the state and various stakeholders. The state could also create an office focused on the Medicare-Medicaid population, similar to the Office of Medicare Innovation and Integration in California.

[i] New York State Department of Health, “New York State Dual Eligible Integrated Care Roadmap” (March 2022), https://www.health.ny.gov/health_care/medicaid/redesign/duals/docs/2022_roadmap.pdf.

[ii] This expansion was advocated for by Medicare Rights and others to address the systemic inequities that older adults and individuals with disabilities face in the Medicaid program. In addition to full Medicaid access, the expansion increased eligibility for the Qualified Medicare Beneficiary (QMB) program to 186% of the federal poverty level.

[iii] Kaiser Family Foundation, “Number of Dual-Eligible Individual, by Type of Medicare Coverage” (2020), https://www.kff.org/other/state-indicator/number-of-dual-eligible-individuals-by-type-of-medicare-coverage/.

[iv] New York State Department of Health, “Providing Integrated Care for New York’s Dual Eligible Members” (December 17, 2018), https://www.health.ny.gov/health_care/medicaid/redesign/integrated_care/docs/2018-12-17_stakehlder_session.pdf.

[v] New York State Department of Health, “Medicaid Managed Care Enrollment Reports” (December 2023), https://www.health.ny.gov/health_care/managed_care/reports/enrollment/monthly/.

Recent Resources

Any changes to the Medicare program must aim for healthier people, better care, and smarter spending—not paying more for less. As policymakers debate the future of health care, we will provide our insights here.

Thinking ahead to Medicare's future, it’s important to modernize benefits and pursue changes that improve how people with Medicare navigate their coverage on a daily basis. Here are our evolving 30 policy goals for Medicare’s future.

You can help protect and strengthen Medicare by taking action on the important issues we are following, subscribe to newsletter alerts, or follow along on social media. Any way you choose to get involved is a contribution that we appreciate greatly.