Join Us Live for a Discussion on Medicare, Democracy, and the Future of Health Care

Kaiser Family Foundation Places Medicare Spending Trends in Historical Context

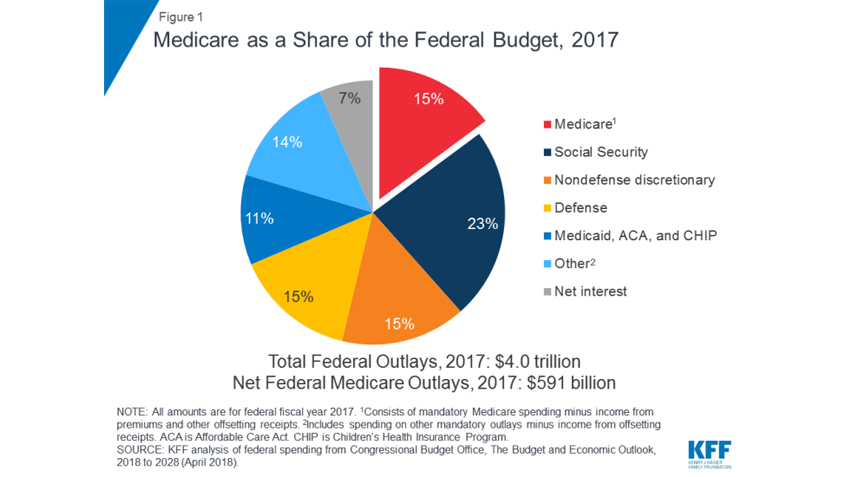

This week, the Kaiser Family Foundation released a new issue brief on Medicare spending. The brief analyzes the most recent historical and projected Medicare spending data published in the 2018 annual report of the Boards of Medicare Trustees and the 2018 Medicare baseline and projections from the Congressional Budget Office (CBO).

In 2017, Medicare spending accounted for 15% of the federal budget, and for 20% of total national health spending in 2016. It also accounted for 29% of spending on retail sales of prescription drugs, 25% of spending on hospital care, and 23% of spending on physician services.

The brief finds that while benefit payments for each part of Medicare increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47% to 42%, spending on Part B benefits (mainly physician services and hospital outpatient services) increased from 41% to 44%, and spending on Part D prescription drug benefits increased from 11% to 14%.

They also note that “recent years have seen a notable reduction in the growth of Medicare spending compared to prior decades, both overall and per beneficiary,” with average annual growth in total Medicare spending at 4.5% between 2010 and 2017. This is down from 9% between 2000 and 2010, despite faster growth in enrollment since 2011 when the baby boom generation started becoming eligible for Medicare.

Kaiser Family Foundation attributes the slower growth in Medicare spending in recent years to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). These changes reduced Medicare payments to plans and providers, increased revenues, and began delivery system reforms to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives.

In addition, they find that although Medicare enrollment has been growing around 3% annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending.

The brief also examines longer-term spending projections, beyond the next 10 years, and financing challenges, and concludes that Medicare spending is likely to trend higher because of growth in both enrollment and per capita costs. In addition, the report points to recent legislative changes, including repeal of the ACA’s individual mandate, as contributors to this growth in spending.

Show Comments

We welcome thoughtful, respectful discussion on our website. To maintain a safe and constructive environment, comments that include profanity or violent, threatening language will be hidden. We may ban commentors who repeatedly cross these guidelines.

Help Us Protect & Strengthen Medicare

Donate today and make a lasting impact

More than 67 million people rely on Medicare—but many still face barriers to the care they need. With your support, we provide free, unbiased help to people navigating Medicare and work across the country with federal and state advocates to protect Medicare’s future and address the needs of those it serves.

The Latest

Most Read

Add Medicare to Your Inbox

Sign up to receive Medicare news, policy developments, and other useful updates from the Medicare Rights.

View this profile on InstagramMedicare Rights Center (@medicarerights) • Instagram photos and videos